VAT REFUND FOR TOURIST

VAT REFUND FOR TOURIST

ALL STORE EXCEPT BATAM

ALL STORE EXCEPT BATAM

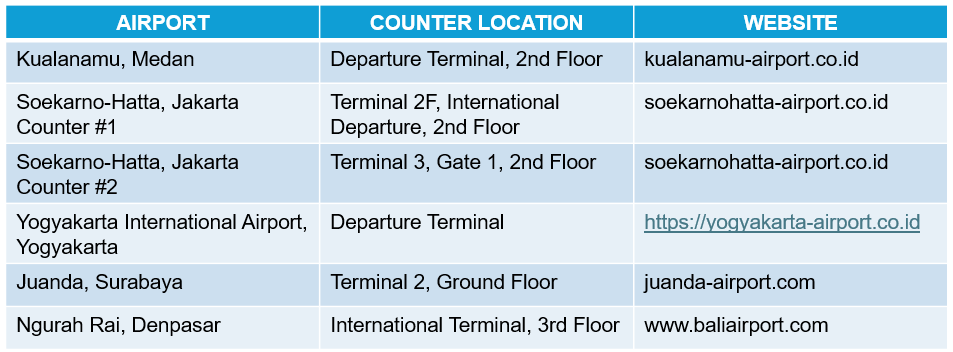

1. Q: Where is the location of VAT Refund counters ?

A: VAT Refund counters are located at selected Indonesian international airports as below :

2. Q: Who is eligible for a VAT Refunds Scheme?

A: VAT Refund counters are located at selected Indonesian international airports as below :

2. Q: Who is eligible for a VAT Refunds Scheme?

A: Any foreign passport holder who is not an Indonesia citizen or not a Permanent Resident of Indonesia, who lives or stays in Indonesia no longer than 60 days upon her/his arrival.

3. Q: When can I get my VAT Refund?

VAT Refund counters will give you VAT refund by cash on the date of departure (for maximum VAT Refund IDR 5.000.000).

Or within 1 (one) month if you requested payment by transfer.

4. Q: How to claim VAT Refund at VAT Refund counters aiport?

A: Access URL https://vatrefundapp.pajak.go.id/

3. Q: When can I get my VAT Refund?

VAT Refund counters will give you VAT refund by cash on the date of departure (for maximum VAT Refund IDR 5.000.000).

Or within 1 (one) month if you requested payment by transfer.

4. Q: How to claim VAT Refund at VAT Refund counters aiport?

A: Access URL https://vatrefundapp.pajak.go.id/

1. Sign in or create new account for new account.

2. Go to menu “refunds” and create new refund claim.

3. Fill in address, deparature and arrival date.

4. Select invoice you want to claim the refund.

4. Select invoice you want to claim the refund.

5. Chose refund methods.

6. Take a picture of your goods.

7. Click Submit.

7. Click Submit.

B. Customer must showing :

1. Sales receipt and VAT Refund Invoice.

- Minimum purchase amount IDR 504.545 (Including VAT IDR 50.000) per transaction.

- Minimum total accumulated purchase amount IDR 5.045.455 (Including VAT IDR 500.000). Can be combined with other purchases.

- Simulation eligible of VAT Refund at the airport :

3. Goods purchased carried out of Indonesia as accompanied baggage (the goods purchased within 1 month before departing Indonesia).

5. Q: How to get VAT Refund invoice from UNIQLO ?

A: Below are the steps to get VAT Refund invoice:

A: Below are the steps to get VAT Refund invoice:

- Buy UNIQLO product at selected offline store with minimum purchase of IDR 504.545 per sales receipt.

- Ask store staff for VAT Refund Invoice (prepare your personal information such as passport and active email to fill in VAT Refund For Tourist Form at selected offline store).

- VAT Refund invoice will be sent via email by next day at 18:00 PM Local Time. (Please consider your flight schedule).

- Issuance of the VAT Refund Invoice is done through Tax System, UNIQLO have no direct control to the Tax System and will not be responsible in the event that there is delay due to the technical issues on the Tax System. In case delay due to system issue, UNIQLO will notice via email to customers and UNIQLO will continue to monitor the status of VAT refund invoice.

- To avoid issues with your VAT Refund Invoice, please ensure all information submitted are accurate. We are not responsible for any incorrect VAT Refund Invoice caused by the incorrect information entered by the Customer in the VAT Refund For Tourist Form.

A: ALL UNIQLO Stores except UNIQLO BATAM. Because Batam is area that is given tax exemption facilities so the purchases in Batam store are automatically not get taxed. However please kindly note VAT refund request should be proceeded by customer on VAT refund counter in selected airport as Q1.

7. Q: Can store give cashback of VAT refund directly to customer after purchase?

A: No, VAT refund request should be proceeded by customer on VAT refund counter in selected airport by showing required documents.

CHAT SUPPORT

CHAT SUPPORT